마인:마켓인사이트

[영어기사/Bloomberg] Fed Set to Pause Rate Hikes, But Don’t Count Out Another Increase(20230920) 본문

[영어기사/Bloomberg] Fed Set to Pause Rate Hikes, But Don’t Count Out Another Increase(20230920)

Insight-er 2023. 9. 20. 09:40- Focus will be on dots that likely will show another 2023 move

- With inflation elevated, FOMC will want to keep options open

The Federal Reserve is expected to pause its interest-rate hikes Wednesday for the second time this year following a slowing in inflation while leaving the door open for another increase as early as November.

The Federal Open Market Committee will keep rates steady at its Sept. 19-20 meeting in a range of 5.25% to 5.5%, a 22-year high. The rate decision and committee forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Powell has signaled that Fed leaders would prefer to wait to evaluate the impact of past increases on the economy as they near the end of their rate-hiking campaign. With inflation still well above the committee’s 2% target and the US economy resilient, officials may pencil in one more hike in their quarterly projections.

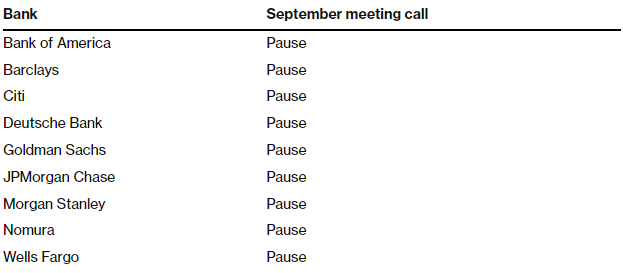

Wall Street Agrees Fed Will Pause Rates This Meeting

There's a unanimous view among the bigger firms on the outcome

“They are not confident enough to say they’ve conquered inflation,” said Julia Coronado, founder of MacroPolicy Perspectives LLC and a former Fed economist. “It is still too high. So you just keep your options open. I don’t think Chair Powell is going to give us the all-clear.”

What Bloomberg Economics Says...

“A rate hold at the Sept. 19-20 meeting is a foregone conclusion. Still, the mixed data over the inter-meeting period mean the next move at the Oct. 31-Nov. 1 meeting is less clear. We expect the updated dot plot released this week to indicate the median FOMC participant sees one more rate hike in 2023, but it will be a close call.”

— Anna Wong, Stuart Paul and Eliza Winger, economists

To read the full note, click here

FOMC Forecasts

Wall Street will be focused on whether Fed officials’ forecasts for interest rates, the so-called dot plot, show the committee seems determined to hike again.

The central bank is divided between more dovish policymakers who are ready to keep rates steady the rest of the year and hawks who want to nudge them up to 5.6% or more.

Economists surveyed by Bloomberg expect the median projection will show one more increase this year and several of them expect a trimming of the number of cuts for 2024.

FOMC May Project Higher-for-Longer Rates as Inflation Persists

Fed forecasts may show faster growth, less unemployment in 2023

The committee could raise its forecast for 2023 growth to about 2%, double its view from June, and look for a firmer labor market with less unemployment this year.

“We think the Fed has delivered enough and the funds rate is sufficiently restrictive,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “But if the labor market does not soften and there are upside surprises on inflation, then there is a risk the Fed will push rates even higher.”

Fed officials will also give their first economic projections for 2026 and update their view of the neutral or long-term interest rate, which some economists expect could rise above the 2.5% estimated in June.

FOMC Statement

The bulk of the post-meeting statement is likely to be nearly identical to the July statement, retaining a hiking bias without a firm commitment to more rate increases. The committee is likely to continue to describe growth as moderate, though it could tweak its description of the labor market, which has become less overheated in recent months.

Governor Adriana Kugler, the central bank’s first Hispanic policymaker, will be joining the committee following her confirmation. No dissents are expected.

Press Conference

Powell, in his press conference, will be pressed on whether he expects another rate increase this year and if he agrees with the rate forecasts in the dot plot.

He’s likely to emphasize that Fed officials will “stay the course” until inflation is under control, said Stifel Financial Corp. chief economist Lindsey Piegza.

“He wants to keep options open and the last thing he wants is for the market to price in rate cuts by early 2024,” she said.

The chair is also likely to be quizzed on upcoming challenges to US growth including a recent increase in energy prices, the prospect of a government shutdown in October and the resumption of student-loan repayments.

URL